Roth Ira Agi Limits 2025. This year will lower your 2025 agi. In 2025, the roth ira contribution limit is $7,000, or $8,000 if.

The annual roth ira contribution limit in 2025 is $6,500 for adults younger than 50 and $7,500 for adults 50 and older. To be eligible to contribute the maximum amount in 2025, your modified adjusted gross income (magi) must be less than $146,000 (up from $138,000 last year).

The roth ira contribution limit for 2025 is $7,000 for those under 50, and an additional $1,000 catch up contribution for those 50 and older.

IRA Contribution Limits in 2025 Meld Financial, Not fdic insured • no bank guarantee • may lose value the charles schwab corporation provides a full range of. The annual roth ira contribution limit in 2025 is $6,500 for adults younger than 50 and $7,500 for adults 50 and older.

IRA Contribution Limits 2025 Finance Strategists, For individuals under 50, the roth ira contribution limit in 2025 is $7,000, a $500 increase from 2025. In 2025, the roth ira contribution limit is $7,000, or $8,000 if.

Roth IRA Limits for 2025 Personal Finance Club, This figure is up from the 2025 limit of $6,500. If you're 49 and under, you can contribute up to $7,000 to a roth ira in 2025.

What Is a Backdoor Roth IRA Benefits and How to Convert Top Dollar, Contribute as much as possible. If you are 50 or.

Roth IRA contribution limits — Saving to Invest, If you qualify to tuck away money in a roth ira in 2025, you'll be able to tap into the biggest contribution limits we've ever seen. The annual roth ira contribution limit in 2025 is $6,500 for adults younger than 50 and $7,500 for adults 50 and older.

What is a Roth IRA? The Fancy Accountant, $8,000 in individual contributions if you’re 50 or older. If you qualify to tuck away money in a roth ira in 2025, you'll be able to tap into the biggest contribution limits we've ever seen.

Roth Limits 2025 Theo Ursala, $8,000 in individual contributions if you’re 50 or older. 2025 contribution limits for different age groups:

Roth IRA Contribution and Limits 2025/2025 TIME Stamped, Individual retirement accounts (iras) are a common source of. You file single or head of.

Roth IRA Rules What You Need to Know in 2019 Roth ira rules, Roth, You’re married filing jointly or a qualifying widow(er) with an agi of $240,000 or more. A roth ira is a retirement savings vehicle that can allow your.

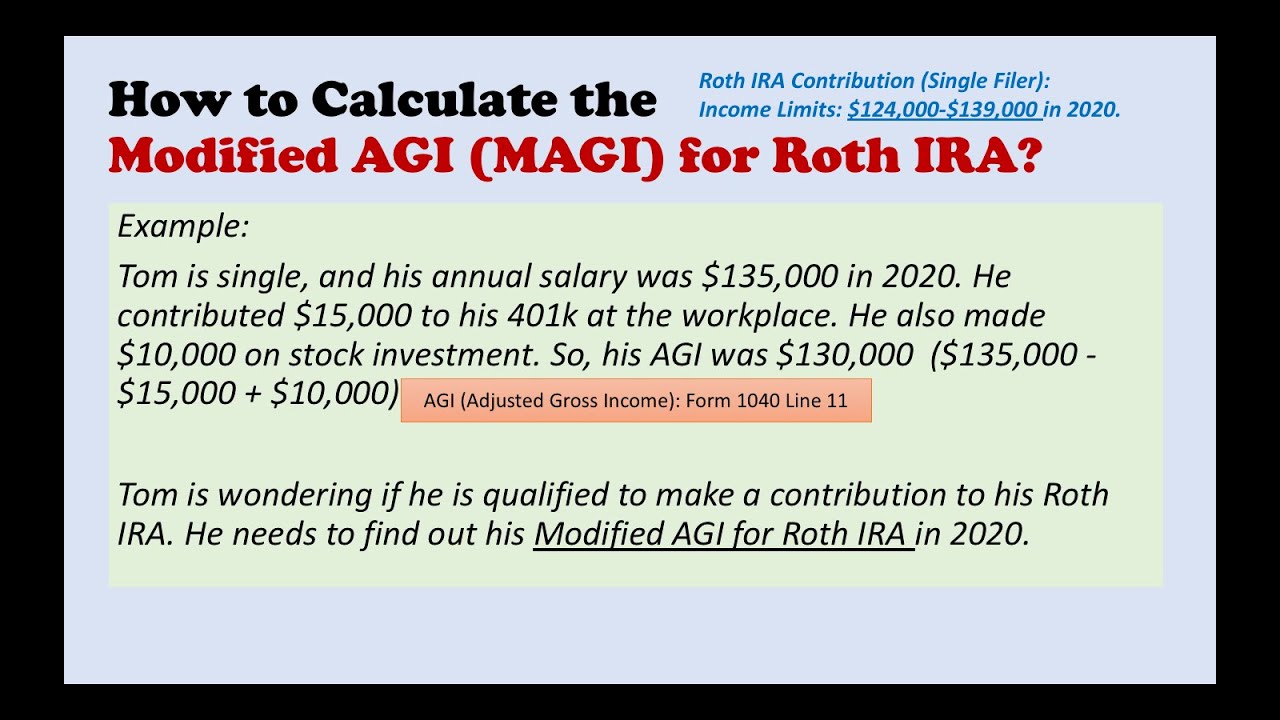

How to Calculate the Modified AGI (MAGI) for Roth IRA? YouTube, The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the 2025 tax year is $6,500 and $7,500 if you're age 50 or older. You file single or head of.

The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the 2025 tax year is $6,500 and $7,500 if you're age 50 or older.

The roth individual retirement account (roth ira) has a contribution limit, which is $7,000 in 2025—or $8,000 if you are 50 or older.